Capacity Modeling for Customer Success

Your guide to tailored Resource Planning for your Customer Success organization

Budgets are tight, bandwidth is stretched and customer expectations rise… All those factors make the need for proper capacity modeling more obvious than ever before. Ensuring adequate resource allocation is crucial for your team to maintain high customer satisfaction and achieve your financial and strategic goals. Capacity modeling, a strategic approach to assessing and forecasting resource needs, plays a pivotal role in achieving exactly this proper allocation. A well rounded capacity plan provides you with a comprehensive framework for understanding the current and future demand for CS services, enabling you and your leadership to make informed decisions about staffing levels, training requirements, and technology investments

Why is portfolio sizing important?

Portfolio sizing is a key component of capacity modeling, as it is the main input factor for accurate resource planning. It means systematically evaluating the size and complexity of each CSMs portfolio to determine the corresponding resource requirements your team has. This is essential for several reasons:

- Effective Resource Allocation: Ensures that the right number of accounts are assigned to each CSM, preventing understaffing or overstaffing. This ensures that customers receive the level of service you want them to have without incurring unnecessary costs.

- Preventing Burnout: Overburdening CSMs with too many accounts can lead to burnout, decreased productivity, and poor customer satisfaction. Portfolio sizing helps you to spread the workload evenly, preventing burnout and maintaining a high level of service delivery.

- Optimizing Resource Utilization: By understanding the size and complexity of each portfolio, you can identify opportunities to optimize your resource utilization. This may involve cross-training your team members to handle different types of accounts or adjusting account assignments to better align with individual team member expertise.

- Data-Driven Decision Making: Portfolio sizing provides you with a data-driven approach to resource allocation, grounding decisions in real-world customer data and historical trends. This ensures that your decisions are informed and aligned with your organizational goals.

Let’s look at some Industry Benchmarks

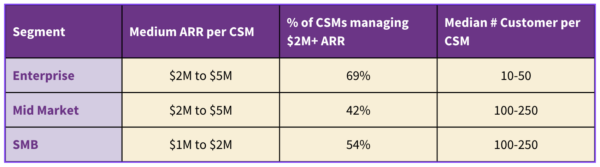

When it comes to segmenting customer success portfolios, organizations often turn to Annual Recurring Revenue (ARR) and customer count as the primary factors. Gainsight’s research indicates that, by far, the primary lever that drives segmentation strategies is ARR managed per Customer Success Manager. Customer count is the second most frequently utilized lever in this regard, with the vast majority of software companies employing a three-segment approach, though there is some variation in the number of segments used, usually ranging from two to five.

Here’s a closer look at the typical ARR and customer count breakdowns for each segment:

What factors to consider when defining your CSM portfolio allocation?

- Segmentation: How do you cluster your customer base? Usually SaaS companies do so by ARR, region, vertical or strategic importance of customers. Based on those segments you need to define the service and engagement level for each of these cohorts. This is the base to forecast the time a CSM needs to allocate per customer and segment.

- Customer Journey: How many touchpoints does a CSM own in each segment and how often do they occur per customer? Also, how time intensive are those touchpoints, to properly forecast the bandwidth needed to perform up to your quality standards.

- Customer Lifecycle Stage: This goes a level deeper from the former point. How many customers in each segment find themselves in which lifecycle stage? How long will they remain in this stage and what level of workload for your CSM is associated with each lifecycle stage?

- Growth Potential & Strategic Accounts: Not for every customer their strategic importance is visible in the hard numbers (just yet). There are accounts we want to invest in through a land & expand strategy, where we see growth potentially. This might require a more subjective approach, as there are often very individual or hart to measure aspects to evaluate in a growth account.

Bottom Up or Top Down?

As ChurnZero suggests, bottom-up portfolio sizing takes your existing resource base (aka the number of CSMs on your team) as the starting point, calculating the maximum number of customers that can be supported by your team. This approach is risk-averse, as it ensures that demand does not exceed capacity. However, it may take away the opportunity to think strategically on how perfect would look like for your customers. This approach follow the following three steps:

- Sum up all the time required to deliver monthly customer touchpoints, both recurring and once-off occurrences. For practicality, smooth out the times within each segment.

- Add all additional non-customer facing activities to the calculation that a CSM performs on top of their customer work. A good benchmark could be ⅓ internal time, ⅔ customer time.

- Now divide this total time by the bandwidth per CSM per month, which will result in the realistic amount of customers a CSM can handle.

Top-down portfolio sizing on the other hand starts with the desired level of service, calculating the required number of resources to achieve this. This approach is more aspirational, aiming to provide the highest possible level of support to customers. However, it may require significant investment in hiring and training new CSMs. If that is not feasible, as realistically a lot of budgeting, planning and organic growth is needed to achieve a high hiring number, you will end up having to go back to the drawing board and compromise on the input factor of your portfolio model. But this is a great approach if you are shooting for the stars, just as IBM who hired an additional 700 (!) CSMs over the last 2 years.

The choice between bottom-up and top-down portfolio sizing really depends on the organization’s risk tolerance and goals. For organizations that prioritize stability and risk mitigation, bottom-up sizing may be a better choice. For organizations that are willing to take on more risk in order to achieve higher levels of customer satisfaction, top-down sizing may be a better fit.

Tooling for the win

The use of technology and tools can help your CSMs to be more efficient and effective in their work. This starts with the CRM used in your wider organization, that helps to store and organize all customer data coming from Pre-Sales and Sales, as well as any Support activities going on. But the real value lay in using a CS Platform to track customer interactions, manage project tasks, and stay connected with customers. By using the right technology, CSMs can free up their time to focus on the most important parts of their job: building relationships with customers, providing value, and driving business outcomes.

Long story short...

By carefully considering all of the discussed factors and follow one of the suggested approaches, you can develop a CSM portfolio allocation strategy that is tailored to your specific needs and goals. This will help ensure that you have the right number of CSMs with the right skills and experience to support their customers effectively, while not stretching anyone’s bandwidth beyond health levels.

This might also interest you

Beyond Internal Walls: Unlocking the Power of External Customer Journey Mapping

From Map to Magic: Turn Your Customer Journey into Actionable Strategies

Decode Your Customer Journey: A Step-by-Step Guide to Mapping Success

Beyond the Score: Transforming Net Promoter into a Growth Engine – Net Promoter System

Turn Your Raving Fans into a Sales Force: Using Customer Advocates as Your Reference Pipeline

Engaging Employees in a Time of Transition: Strategies for Boosting Morale and Productivity

Capacity Modeling for Customer Success

Data Driven Customer Success